- ABOUT US

- CARGO

- PASSENGERS

- MULTIMODALITY

- ECOLOGICAL TRANSITION

- INNOVATION

Containers: a promising recovery

Against this dynamic backdrop, driven by the recovery of European consumption, HAROPA PORT recorded a particularly strong rebound.

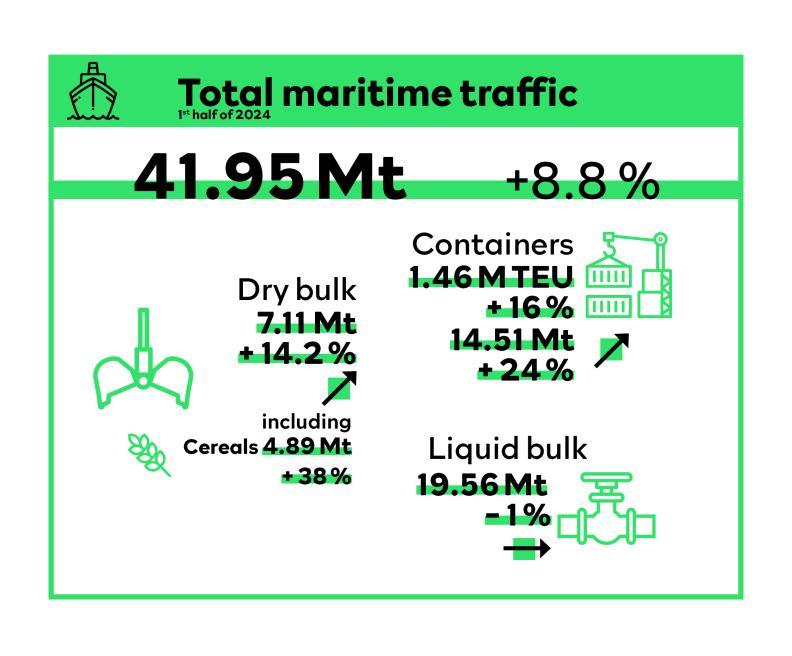

Containerized traffic represented 14.51 Mt in tonnage, up 24%. In TEU terms, the first half of 2024 saw a 16% increase to 1.46 MEVP. This positive dynamic is also reflected in hinterland flows, with 1.07 MEVP (+ 6%). In particular, full container traffic to and from the hinterland increased by 10.7%.

Container transshipment, which exceeded the 2019 level with 0.39 MEVP, testifies to shipping lines' confidence in the regularity of calls and the performance of the maritime hub.

Cereals: the 2023/2024 campaign ranks 5th among the best ever

The solid bulk sector recorded a total of 7.11 Mt at the end of June. This represents an increase of +14.2%, mainly driven by agro-industry.

HAROPA PORT handled a total of 4.89 Mt of cereals, an increase of 38%. June 2024 was a very active month, with 738,000 t of cereals exported.

With 8.72 Mt, the 2023/2024 export campaign ranks 5th among HAROPA PORT's best cereal campaigns. Final tonnage was up + 1.8% on the 2022/2023 campaign.

HAROPA PORT's market share of French maritime cereal exports remains stable at around 52%. With this good result, the five-year average rises to 8.2 Mt.

Milling wheat accounted for 5.92 Mt, barley for 2.66 Mt (including 1.84 Mt of feed barley and 0.82 Mt of malting barley). Other exports (durum and feed wheat) totaled 0.14 Mt.

The Maghreb remained the leading destination with a total of 3.25 Mt, ahead of Asia with 2.55 Mt, and West Africa set a new record with 1.42 Mt (against 1.1 Mt previously).

Less common destinations for Rouen : Mauritania, Mexico, Thailand, India, Colombia, Madagascar, the United States and South Africa.

Also in the solid bulk sector, imports of aggregates were down sharply by -48.6% to 555,474 t, while cement/clinker imports were down by -3.5% to 183,616 t. Solid fertilizers posted a flow of 452,165 t, up +36.3%. Other solid bulk reached 1.02 Mt, down - 5%.

Vehicles up 18%

At the end of June 2024, Ro-Ro traffic at the dedicated terminal was still progressing positively, with 155,237 vehicles + 18%, i.e. 23,200 vehicles more than in June 2023.

A good start to the cruise season

The cruise activity continues to perform well with a fine season underway, up +30.3% or +55,000 passengers, and +21.5% in the number of calls (i.e. 17 more than at the end of June 2023).

The Rouen, Honfleur and Le Havre terminals recorded 237,473 passengers, up 30.3%, for 96 liners, up 21.5%.

Bulk down, with the exception of gaseous hydrocarbon traffic

Liquid bulk traffic fell slightly to 19.56 Mt, down 1%. Crude oil traffic totaled 8.83 Mt, down 2.4%. Refined products totaled 7.85 Mt, down slightly by -1.2%. Chemical products totaled 1.79 Mt, down - 3.6%. The impact of the closure of Exxon Mobil's petrochemical unit will begin to be felt in 2025.

Traffic in gaseous hydrocarbons reached 0.75 Mt, an increase of +45.1%. These are flows operated by the floating LNG terminal, the FSRU Cape Ann, which began production in September 2023.